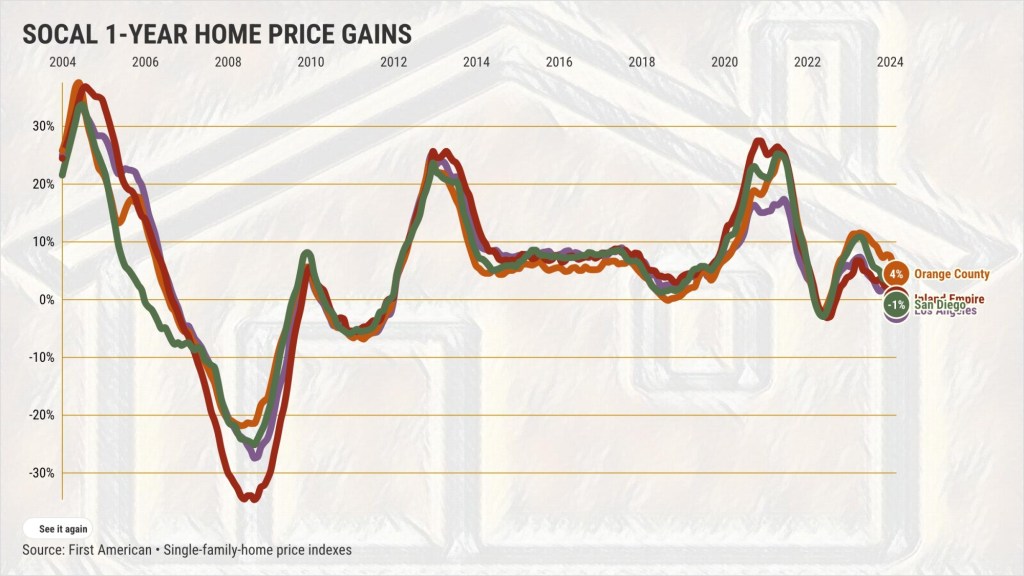

Home prices weakened across Southern California as 2025 started, with only one local market – Orange County – showing rising prices in January.

My trusty spreadsheet examined intriguing indexes from First American Data & Analytics, which tracks four local housing markets. These yardsticks follow overall pricing patterns for single-family homes, dividing each market into cost buckets: the most affordable starter homes, mid-tier residences and high-end luxury.

Orange County’s 4.4% price rise for the 12 months ended in January was still its smallest gain in 18 months. Prices rose 6% annually in December and 11.3% in January 2024.

The O.C. gain was consistent across the price slices in January: 4% annual gain for starter homes, 4.5% mid-tier increase, and 4.5% luxury rise.

House hunters got better news in Los Angeles County, where home prices were down 1.9% overall for the 12 months—the worst drop in 22 months. That was a growing decline compared to the 0.2% one-year dip in December and a far different pricing tale than the 7.1% annual gain from January 2024.

Looking at L.A. by January’s price slices, the low-end had the most significant cuts with a 1.5% price decline in starter homes vs. a 0.8% mid-tier increase and a 1.1% luxury dip.

Another dip was found in San Diego County, where prices were off at a 0.9% annual rate in January – worst in 20 months – vs. a 2% one-year rise for December and 10.6% above a year ago.

Starter homes also took the most significant cuts in San Diego, down 2.4% in a year vs. a flat mid-tier and a 0.4% luxury rise.

Abd Inland Empire prices were flat in a year for January – worst in 19 months – compared to 1.7% annual hikes as of December and a 6.7% rise in January 2024. By price slice, January had an 0.9% starter gain, flat mid-tier, and 2.2% luxury rise.

What’s up, or not?

As 2025 unfolded, local sellers found themselves in the weakest spot since early 2023.

That was when the Federal Reserve’s end of its pandemic-era cheap money policy was scaring off house hunters. By price slice, the lower end had the meekest pricing strength in January, a reminder that the region’s affordability challenges remain steep.

Curiously, this latest pricing softness follows another Fed switch – ending its interest rate hikes. Late last year, the central bank lowered short-term rates, but those cuts did not stop increasing mortgage rates.

Remember, you need a solid paycheck or two to be a Southern California buyer. As 2024 ended, the region had a record number of workers, but hiring decisions were mixed by industry.

That uncertainty increased worries about job security, which is not a positive for house hunting.

Bottom line

The First American study tracks 30 U.S. markets – and Southern California decidedly underperformed in January.

Collectively, 20 markets had one-year price gains, eight had declines, and two were unchanged.

Yes, Orange County had the fourth-biggest gain among the 30. However, the other three local markets were in the bottom 10 – Inland Empire, No. 21, San Diego, No. 26, and Los Angeles, No. 28.

The 30 markets’ biggest gain overall was in Pittsburgh, up 10% in a year. The most significant price drops were in Oakland and Tampa, off 3.8%.

Nevertheless, 2025’s early price weakness doesn’t dent house hunter’s immense hurdles: Prices in five years are up 61% in Orange County and San Diego, 59% in the Inland Empire, and 39% in L.A.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com