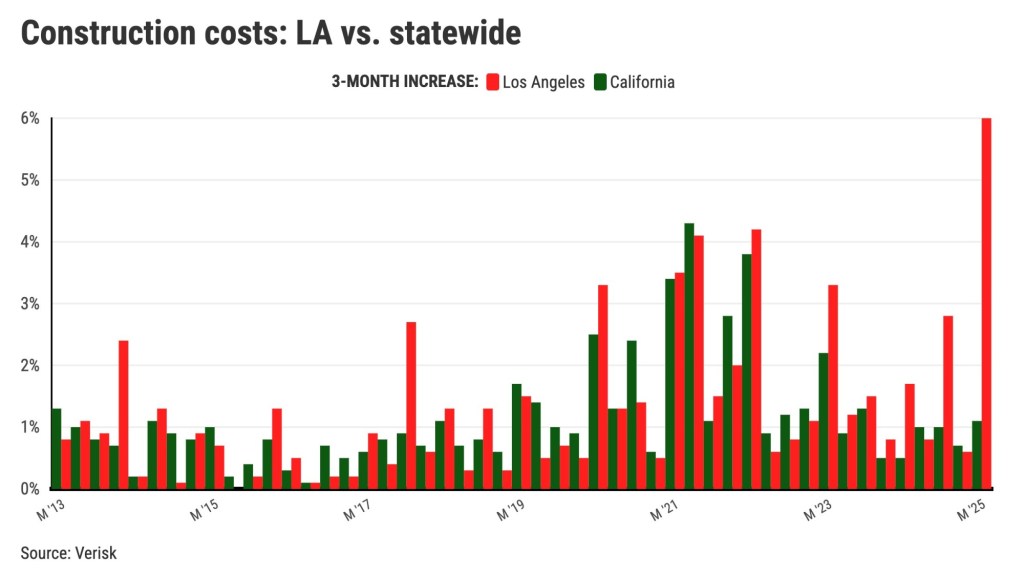

The cost of construction near the Los Angeles wildfires surged at the fastest rate on record as 2025 began, another burden for the victims of January’s firestorms.

Home repair expenses jumped 6% around the city of Los Angeles in just the first three months of the year, according to my trusty spreadsheet’s review of construction-cost expenses in 33 markets statewide, as tracked by Verisk.

That was L.A.’s largest quarterly jump in a database that dates to 2013, and the first quarter’s biggest jump statewide. Also, it brought L.A.’s construction cost jump to 10.5% for the year ended in March.

The No. 2 cost bump statewide was in nearby San Fernando, with construction 4.1% pricier in the quarter. That was San Fernando’s second-largest increase on record, as the market’s costs rose 7% in a year.

Demand for construction services soared after massive wildfires destroyed 10,000-plus structures around Altadena and Pacific Palisades in early January. Labor costs were a big factor, pushing local expenses higher near the wildfire damage, says Verisk’s Greg Pyne. L.A. labor was 6.4% pricier since January and 7.8% higher in San Fernando.

Those cost hikes around the fire zones contrast with more modest increases elsewhere. Verisk’s statewide index showed construction expenses up 1.1% in the first quarter and 3.8% in a year. Nationally, costs rose 0.9% in the quarter and 4% in a year.

The wildfire fallout on construction costs has spread across Southern California, with eight markets suffering above-average hikes.

After L.A. and San Fernando, the next largest jumps were just west of the fire zones: Ventura costs rose 2.6% in the quarter and 4.6% in a year. In Simi Valley, construction was 2.5% pricier in the quarter and 5.1% in a year.

Other Southern California markets with cost jumps above the statewide increase were San Diego (up 2.2% in quarter, 4.9% in a year), San Bernardino (up 1.5% in quarter, 3.8% in a year), Orange (up 1.4% in quarter, 3.9% in a year), and Santa Barbara (up 1.2% in quarter, 3.7% in a year).

These early 2025 cost surges are a break from a broader trend of moderating construction inflation. For example, Verisk’s statewide index grew at a 7% annual pace in 2019-24 – more than six times faster than the current pace.

Construction expenses jumped around the pandemic as growing demand for building projects bumped into labor shortages and thin supplies of building materials. But in the past year, a slower real estate market, tied largely to high mortgage rates, dampened prices for construction services and goods away from the fire zone.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com