Why are Inland Empire house hunters so reluctant to buy?

Well, house payments have roughly quadrupled since their post-Great Recession lows.

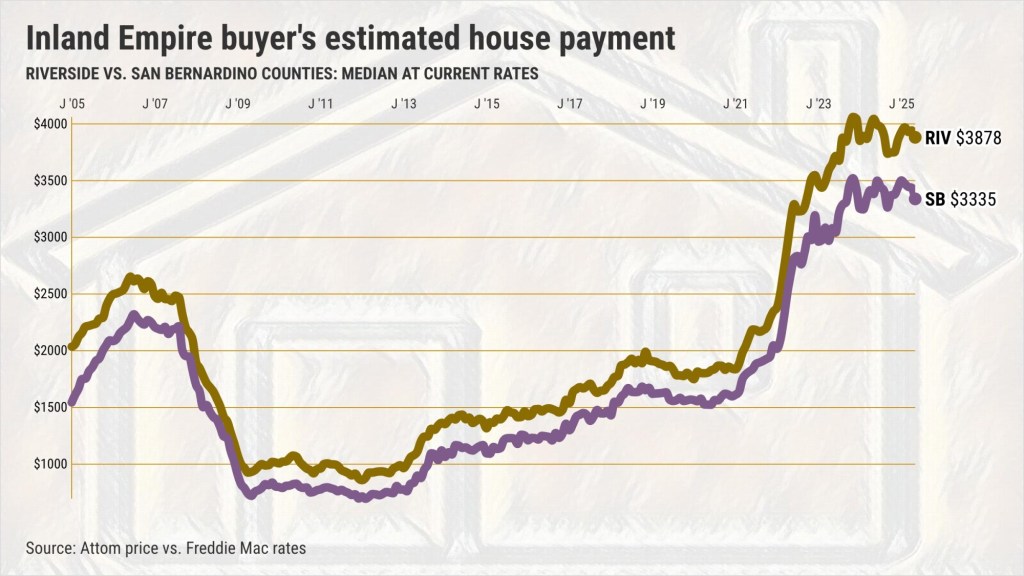

To track the affordability woes of local housing, my trusty spreadsheet analyzed median sale prices from Attom and 30-year fixed mortgage rates from Freddie Mac. An estimated house payment was calculated for all residences – including houses and condos, both existing and newly built properties – assuming a 20% down payment.

In Riverside County in May, the $599,000 median-priced residence – financed at the 6.8% average rate of the previous three months – cost an estimated $3,878 monthly. That’s the 14th-highest cost on record.

In San Bernardino County, the $515,000 median at the same rate costs an estimated $3,335 a month, the 17th-highest cost on record.

The last bargain

Let’s go back to when the housing market was recovering from burst housing bubble.

In Riverside County, a homebuyer’s burden hit its bottom at $855 in January 2012. How so? Borrowers were getting 4% mortgage rates and a $180,000 median home price.

Riverside County prices slid 56% in the previous five years. But in May 2025, a house hunter saw prices that were up 46% in five years.

The Riverside County house payment has skyrocketed 354% since its bottom. And prices, up 233% in the period, are roughly two-thirds of the problem.

During San Bernardino County’s post-crash low in February 2012, a homebuyer’s cost was only $691 a month.

That was for a $146,000 median priced home after prices dropped 59% in five years. In May 2025, prices increased 49% in five years.

So San Bernardino County’s house payment jumped 383% from its trough. Home prices are up 253% in the period.

How reluctant?

Homebuying in Riverside County ran 31% below average in May. It was also the No. 2 slowest May over 21 years.

Meanwhile, sales were 37% slower than average in San Bernardino County. It was also the No. 2 slowest May on record.

Or take a longer-term peek – total sales in the 12 months ended in May — Riverside County was 30% below the 21-year average, and San Bernardino was off 34%.

The price is wrong

Price relief may be brewing.

Gains in Riverside County averaged 7.9% annually during the last five years. But prices fell 1.8% in the past 12 months.

In San Bernardino County, appreciation that has run 8.3% annually during the last five years slowed to 1% in the past year.

Not just here

This is not simply a financial hurdle for local house hunters.

In the six Southern California counties: Homebuyers are looking at $825,500 median costs at $5,345 a month in May vs. the January 2012 low when the $260,000 residence cost $1,235 monthly. That’s a 333% jump.

California: $750,000 median costs $4,856 in May vs. January 2012’s $232,000 residence that cost $1,102 monthly – a 341% jump.

Nationwide: $367,000 median costs $2,376 a month in May vs. February 2012’s $136,325 residence that cost $645 monthly – a 269% jump.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com