Why are so many Californians grumpy about the economy?

Ponder a quirky economic statistic called “real wages” – a yardstick comparing the growth in pay vs. the inflation rate. This measurement shows the typical paycheck was battered by a ballooning cost of living during the past four years.

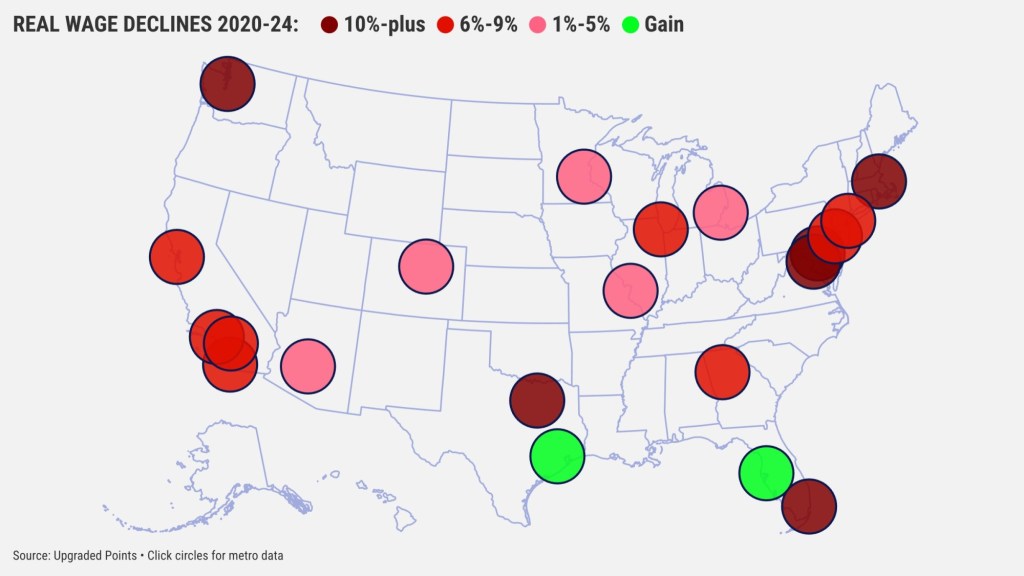

My trusty spreadsheet looked at a study by Upgraded Points, a financial information website, which eyeballed pay and price patterns from late 2020 – just as the worst bout of inflation in 40 years was percolating – through 2024. Federal wage stats were contrasted against cost-of-living swings in 21 metropolitan areas with local Consumer Prices Indexes, including four in California.

Now if there’s any good California news in the report, it’s that the Golden State declines in real wages ranked in the middle of the pack among the 21 U.S. regions. So, the growing struggle to pay the bills is not just a California concern.

That is modest solace for shrinking purchasing power. Contemplate the math behind real wages, starting with the Inland Empire.

Wages paid in Riverside and San Bernardino counties grew by 15% in 2020-24, the ninth-highest jump among 21 regions. That translates to $1,000 in pay becoming $1,150.

However, the region suffered a 22% surge in local living costs in the same period, the eighth-highest nationally. That pushed $1,000 in consumer expenses to $1,220 in four years.

That raise-to-inflation shortfall meant the buying power of the typical Inland Empire paycheck decreased by 5.6% in four years. That’s not pretty yet it’s the most minor dip in the state and eighth-smallest among the 21 regions.

In Los Angeles and Orange counties, real wages fell 6.1% (No. 13 of the 21) with 12% raises (No. 11) outpaced by 20% inflation (No. 15).

The Bay Area’s 7.2% real wage decline ranked mid-range 11th. The region comprising Alameda, Contra Costa, Marin, San Francisco, San Mateo counties saw 7% raises (No. 18) outstripped by 15% inflation (No. 21).

And real wages in San Diego County took the state’s worst dip, down 7.9% in four years and ninth-biggest among the 21 regions. That drop came from 13% raises (10th highest) outpaced by 23% inflation (No. 7).

National extremes

The chasm between noteworthy raises and loftier cost-of-living growth across the nation often paralleled the broader economic patterns during these four years.

You see, surging regional economies can produce higher-than-normal inflation.

Consider the only regions with higher real wages over four years – fast-growing Houston, up 6%, and Tampa, up 4%. Baltimore, not a boom town, had the most significant drop in real wages, off 14%.

When it came to actual paycheck increases, Tampa had the biggest raises, up 31%, while Baltimore had the smallest, at 4%.

The worst inflation was found in another growth spot: Miami, up 28%. The lethargic Bay Area economy had the smallest cost-of-living increase at 15%.

Bottom line

Slumping real wages help explain why a poll conducted by Upgraded Points found the cost of living the No. 1 “financial challenge facing families” for Americans.

The survey showed 42% of those surveyed were most concerned about inflation. It’s probably because 27% of folks surveyed were also anxious about insufficient wages. Another 17% cited unnecessary spending as their top money woe. And thanks to a relatively strong job market, only 14% worried most about employment instability.

The loss of buying power created a yearning for the good ol’ days, as 71% of people polled said it’s harder for the average family to get by now than it was 10 years ago.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com