You’d need to earn $132,000 annually to comfortably finance the purchase of the typical San Bernardino County condo.

This is simply another way to view local homebuying’s affordability headache. How did we establish that budgetary standard for what’s arguably the “bargain” homeownership option?

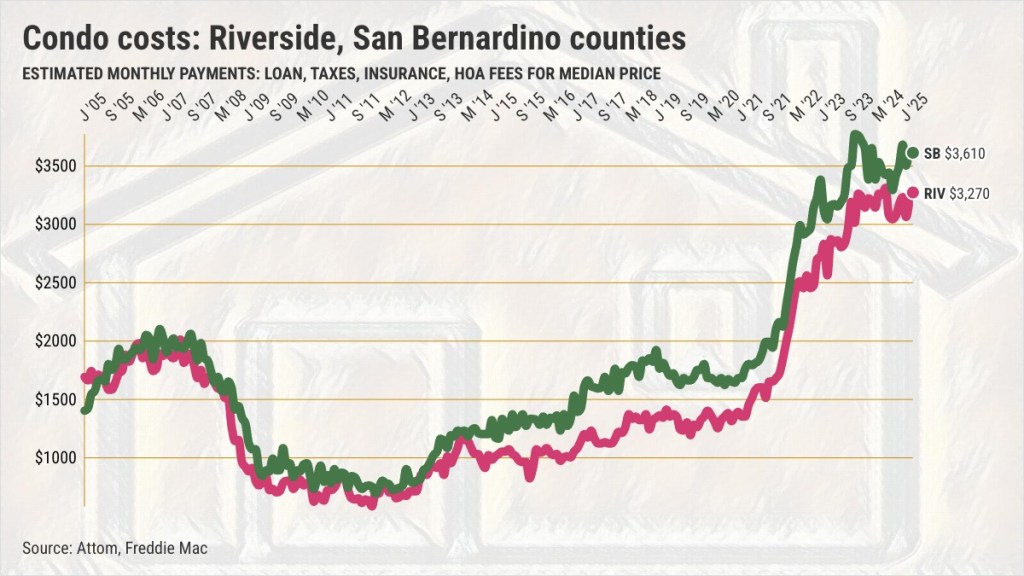

Well, my trusty spreadsheet looked at monthly pricing data from Attom, which tracks closed sales for existing condos and newly built ones and 30-year fixed-rate mortgage data from Freddie Mac. For historical context, March results were compared with March 2024 – plus March 2019, as a measurement of homebuying before the economy-twisting pandemic.

Here’s the math, which can serve as a condo seeker’s checklist of the funds needed.

The basics

Price tag: In March, a San Bernardino County condo’s median selling price was $589,250 – off 2% in a year but 59% higher in six years.

Interest rates: To gauge the loans recent buyers used, we took the average rate for the three months ending in March of 6.82% vs. 6.75% a year earlier and 4.37% six years ago.

Repayment: How much to the lender? We assumed only a 10% down payment – a smaller-than-normal amount that’s common with cost-conscious shoppers. But that means the mortgage rate goes up 0.4 percentage points to account for the bank’s higher risk. Based on the March median and rates in San Bernardino County, it equals $3,610 a month to pay off the loan.

Extra expenses

The down: The cash you bring to the deal is the real hurdle for many condo seekers. Remember, a downpayment of 10% of the latest San Bernardino County median is $58,925 – off $1,125 in a year but $21,775 higher in six years.

“Other” costs: The lender looks at more than the mortgage expenses. Qualifying costs include property taxes, insurance and homeowners association dues. Let’s estimate that’s equal to 1.6% of the purchase price. San Bernardino County, that’s another $790 you must include in your budget.

The “real” payment: So, the actual condo payment — paying the lender plus taxes, insurance and HOA dues — in San Bernardino County totals $4,400 every month. This condo burden – what lenders use to qualify a borrower – shrank $50 in a year but is $2,150 higher in six years.

Bottom line

How much must you earn to qualify?

Let’s assume the San Bernardino County condo payment is 40% of your income, a higher level of spending that’s customary with first-time buyers. Your household will need to make $132,000 a year, an income threshold that’s off -1% in a year but 96% higher in six years.

Contemplate this same condo burden in other local counties – the income needed to buy the median-priced property? Orange ($189,000 annual income for $845,000 condo), Los Angeles ($162,300 for $725,000 condo), San Diego ($154,200 for $690,000 condo), Ventura ($142,800 for $639,500 condo), and Riverside ($119,400 for $535,000 condo).

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com