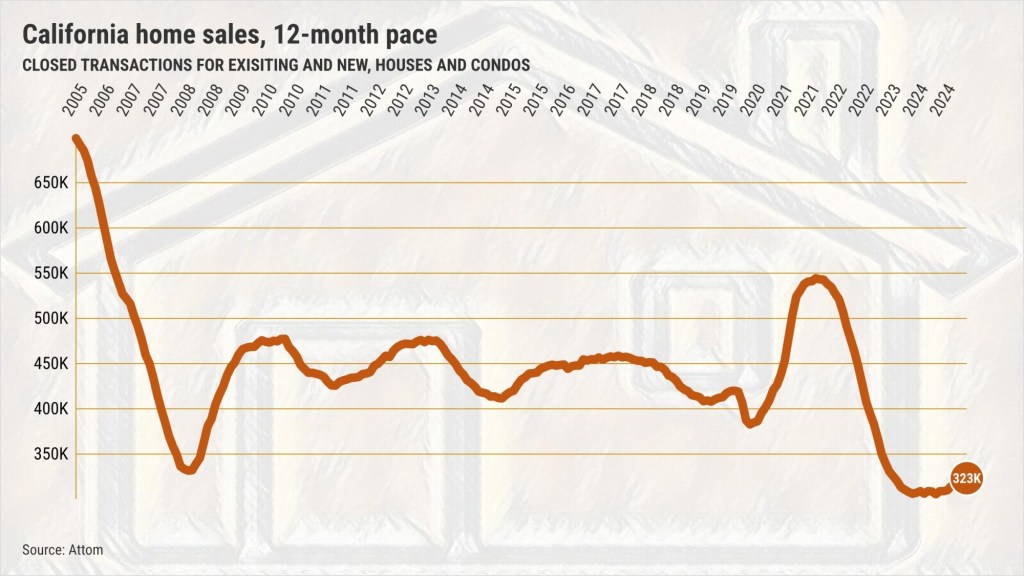

Call it what you want, but California’s homebuying pace remains below the Great Recession’s bottom.

My trusty spreadsheet reviewed a new set of home sales figures created for the Southern California News Group by real estate tracker Attom. These broad-based statistics track closed transactions by month and include existing and newly built residences, whether they are houses or condominiums. The data dates to 2005.

In February, 22,002 California residences were bought. While that’s down just 1% in a year it’s also the third-slowest February on record and 24% below the 20-year average for the month.

Since the Federal Reserve began raising interest rates in early 2022 to fight the worst bout of inflation in four decades, the homebuying pace has collapsed/chilled/crashed/whatever.

The deep reluctance to buy can be seen in the rolling 12-month count of home sales. Across California, 322,813 residences were sold in the year ending in February, down 40% in three years and 27% less than the two-decade average.

Yet ponder this ugly marker: During the Great Recession’s darkest days, this California sales yardstick bottomed at 331,196 in the year ending in May 2008. The statewide sales pace next dropped below that statistical valley in June 2023. The pace has remained slower than the crash era’s nadir for 21 months.

To be fair, homebuyers are now almost 10% more active than they were at the 20-year low of 305,049 sales back in June 2024. Still, today’s homebuying is less than half of the historic sales peak – 698,782 purchases at December 2005. That’s back in the subprime bubble days.

The price is wrong

One major housing headache is that pricier mortgage rates have yet to cool home price gains in California.

The median sales price in February was $740,000, up 12% during these three years. The peak was $750,000 in May 2024, so we’re only 1% off the all-time high.

So think about affordability over the past 20 years – comparing price moves and the average 30-year fixed loan rate at 6.8% in February 2025 vs. 5.6% in February 2005.

A California buyer of that median-price home would have seen their estimated monthly house payment – assuming a 20% downpayment – grow by 110% over two decades.

However, statewide household incomes were up just 82% in the same period, according to the Census Bureau.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Originally Published: