A modest dip in mortgage rates wasn’t enough to prevent drops in California home prices and sales.

To see what’s up – or down – with the market, my trusty spreadsheet looked at statewide homebuying data from the California Association of Realtors and the average 30-year mortgage rate from Freddie Mac.

May’s results showed that cheaper money was no panacea for the stalled housing market. The 30-year mortgage rate averaged 6.8% that month, down from 7.1% in May 2024.

So, a California house hunter’s estimated house payment – the monthly check for a $900,000 median-priced home at the 30-year rate – has fallen 3% in a year to $4,700. Still, that burden tripled in 10 years.

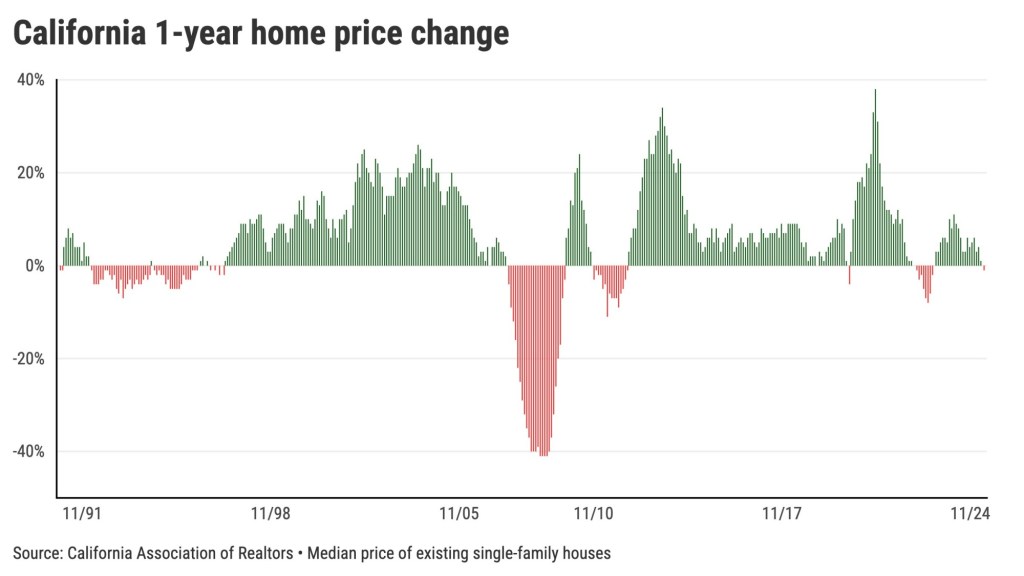

That incredible lack of affordability nudged California prices lower. The median was off 1% since May 2024 – the first 12-month drop in prices since June 2023. By the way, this year-over-year price benchmark has fallen in 26% of the months in the past 36 years.

Still, May’s median is just $10,000 off its all-time high. Is it really a surprise that May’s statewide sales were down 4% year-over-year? It was the biggest drop in 17 months.

Additionally, it appears that homeowners rushed to sell, as May’s 3.8 months of supply represents a 46% increase from a year ago. But their homes are sitting unsold longer. The number of days on the market has risen by five to 21 since May 2024.

The best news for housing, though, comes from government employment data.

California’s job market is merely sluggish. May’s job growth was a modest 0.5% for the year, as unemployment increased slightly to 5.3%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com