By Erin El Issa, NerdWallet

Some Americans likely grew up not openly discussing finances at home. According to a new NerdWallet survey conducted online by The Harris Poll, 20% of baby boomer parents (ages 61-79) didn’t teach their children about saving money.

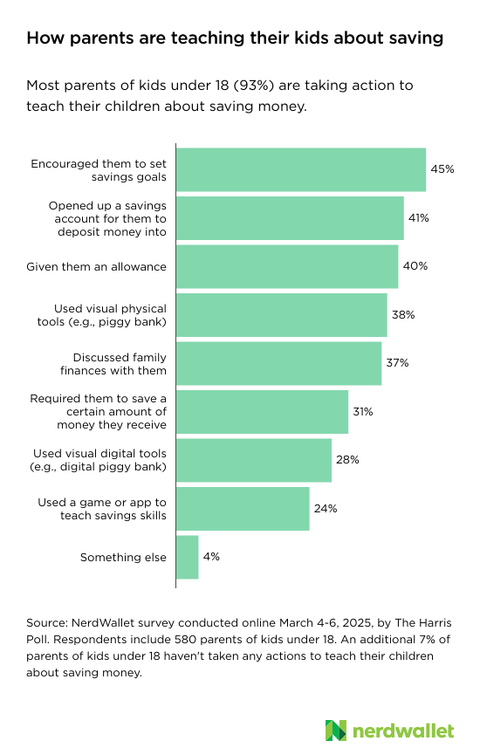

Perhaps because talking about finances has become less taboo, today’s parents of young kids are prioritizing this life lesson: The survey found that 93% of parents of children under 18 have taken action to teach their kids about saving money, like encouraging them to set savings goals (45%) or opening up a savings account for their children to deposit money into (41%).

If you’re a parent who wants to teach your kids about saving money, here are a few options to consider.

1. Set kids up with an age-appropriate savings vehicle

According to the survey, 41% of parents of children under 18 opened a savings account for their kids to deposit money into as a way to teach them about saving. Additionally, some parents of minor children used visual tools — whether physical (38%) or digital (28%) — like piggy banks or savings jars.

For young kids, a piggy bank or savings jar is probably a good place to start. Sure, they aren’t yet earning interest, but having tangible bills and coins allows them to begin learning the value of denominations and how to count cash, before moving on to opening a savings account or using a banking app.

You can open a savings account for a child, regardless of their age, jointly owned by the parent and the kid. In addition to your own personal information and photo ID, you’ll likely need to provide the child’s name, date of birth, and Social Security number when opening the account. You could opt for an online-only bank or a local brick-and-mortar, but keep in mind that some banks may require an account for a minor to be opened in person. Look for a savings account option that doesn’t charge monthly fees and has a decent interest rate.

Nowadays, there are also banking apps for kids. These may include educational activities, savings goal features, allowance tools and parental controls. The downside is that some apps charge monthly fees and/or don’t pay interest. So you’ll need to decide if the interactive features are worth the added cost.

2. Consider giving your kids an allowance

The survey found that 2 in 5 parents of minor children (40%) have given them an allowance to teach them about saving money. For school-aged children, this may be a good option. Whether an allowance is tied to chores or not, a small weekly allowance can be a starting point for learning how to manage competing financial priorities — like saving, spending and giving.

According to the survey, nearly a third of parents of children under 18 (31%) require their kids to save a certain amount of money they receive as a way to teach them about savings. You could give your children guidelines on how much to save, spend and donate, or allow them to decide on the allocation themselves. You can further this discussion by talking to your kids about how you make these decisions when it comes to the family finances.

3. Discuss your financial goals with your kids and ask about theirs

Less than 2 in 5 parents of minor children (37%) have discussed family finances with their kids to teach them about money, according to the survey. While you naturally don’t want to burden children with money stress, there are age-appropriate ways to use your own finances to teach kids about saving.